Most students face financial crises and inconveniences because they don’t have any regular financial source unless their parents support them. In addition, they are also not allowed to work more than the required hours because of their enrolment in any educational institute. So, it is critical for them to manage their finances and ensure they don’t find themselves in a financial crisis at any point in time. Therefore, they make a budget and try to follow it.

There is no hard and fast rule or budget sheet that every student can follow as the budget depends on a person’s affordability, saving goals, lifestyle, and much more.

Download

[For Excel: xlsx & Polaris Office] [Size: 8.0 KB]

OTHER OPTIONS

Download

[OpenDocument Spreadsheet .ods] [Size: 30 KB]

Download

[For Excel: xlsx & Polaris Office] [Size: 8.0 KB]

OTHER OPTIONS

Download

[OpenDocument Spreadsheet .ods] [Size: 30 KB]

What is a student budget?

A student budget is another type of financial plan that a student makes and follows to meet his short—and long-term goals. Many students consider the upcoming university fees, and for this purpose, they make a financial plan that can help them reach their goals.

Students who are not good at making financial plans often use different online tools that help them not only make a plan but also follow it. The student budget planner is an excellent tool for enrolled individuals who want to avoid the stress of calculating the cost of everything.

Why is it essential to use a student budget planner?

The planner is a very helpful financial tool for students who want to manage their finances to pursue their education. The basic objective of using this tool is to enable students to allocate their available resources wisely. Students can also plan for their expenses and ensure they don’t get into a financial crisis by spending more than required.

Students usually have to rely on other people in order to cover their academic expenses. Therefore, when they don’t perform the fund management, they have to ask for more money which is often embarrassing for most of them.

How to create the student budget with the help of a planner?

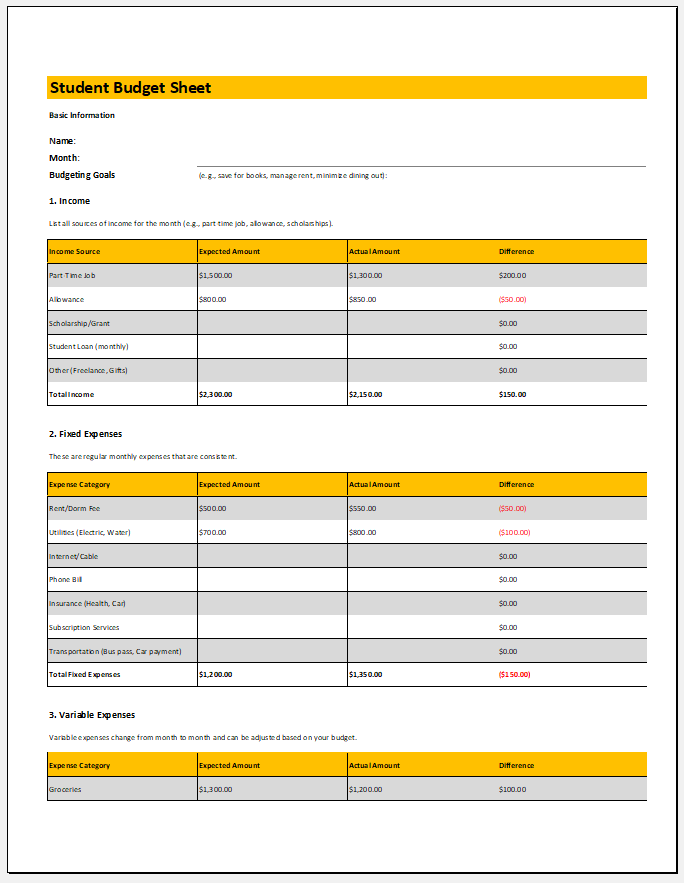

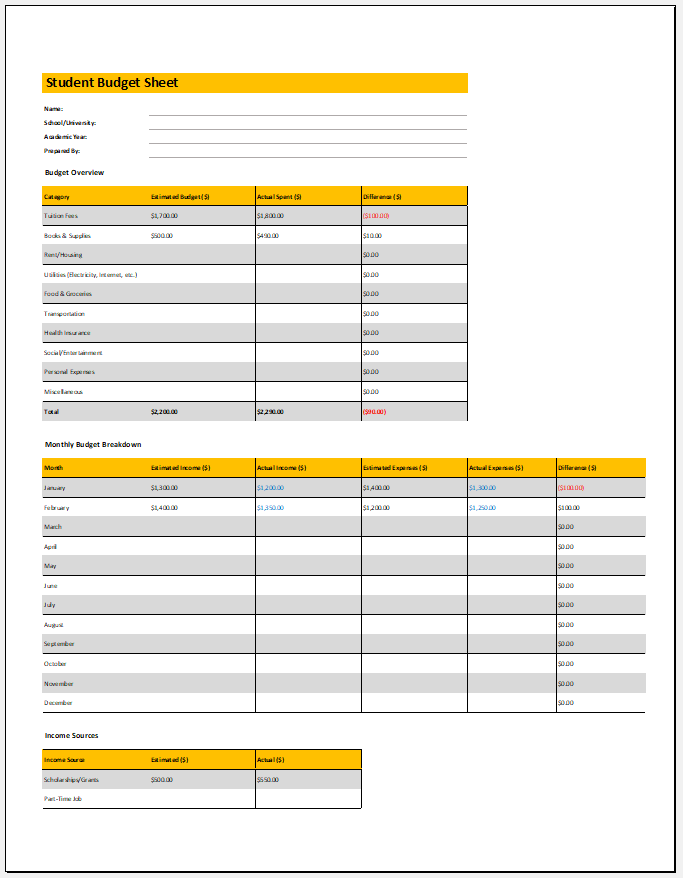

The most important aspect of creating the budget that should always be taken into account is the income or pocket money a student is getting every month. For this, pocket money from parents, scholarships from the institute, income from part-time work, and all other sources of income should be stated. The collective income is then calculated and kept into account.

Take notes of tuition and fee details:

The biggest and most prominent expense a student has to bear is the fee of the institute in which he is enrolled. The budget sheet should be aware of this big expense as all the other goals and decisions revolve around it. If the tuition fee has to be paid in instalments, this should also be mentioned on the sheet.

Keep track of housing expenses:

There are many such expenses that are closely related to housing expenses, such as the cost of the hostel or the apartment the student has rented, the total amount the student pays for utility bills, and all other relevant details.

Cost of food:

Since many students live outside the house, they must also pay for food and groceries. It is wise to keep track of the expenses incurred when food is purchased. The cost of each grocery item should be known, and the total amount spent on the groceries should be listed.

Transportation expenses:

If a person studying in an institute has not been given free transportation, he will have to take the transportation expenses into account. Transportation does not take much of the money from the set budget. However, it is important never to ignore it.

Conclusion:

Students must manage their finances to save money for upcoming fees and live within their means. This helps them stay organized, and they don’t feel the need to borrow money from anyone. In other words, they get themselves together when they use a budget planner designed for them.

- Employee Performance Review Sheet

- Reward Chart Template

- Fuel Claim Form Template

- Wedding Invitation Tracker

- Food Budget Estimate

- Rent Affordability Calculator

- Student Budget Sheet

- Personal Budget Tracker Template

- Project Budgeting Sheet

- Funding Request Worksheet

- Management Team Worksheet Template

- SWOT Analysis Worksheet Template

- Stock Register Template

- Business Budget Sheet Template

- Fuel Budget Calculator