Just like individuals, companies also need to keep track of their expenses to avoid the situation in which they are on the verge of bankruptcy. Management of expenses is important for every business.

A company usually has some growth strategies that it follows to expand its operations. The goals of growth and expansion can never be met unless a business chooses to make a budget and follows it religiously.

What is a business budget?

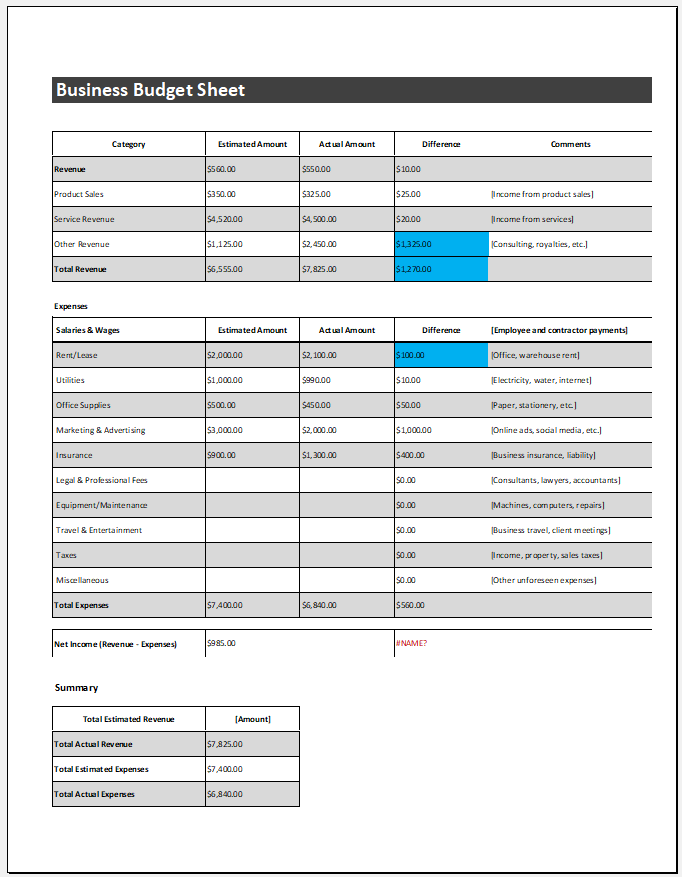

A business budget is a financial plan that every organization makes for efficient fund management. Businesses usually use the budget because they want to have a clear picture of their financial goals throughout the entire fiscal year or over a quarter.

Download

[For Excel: xlsx & Polaris Office] [Size: 8.0 KB]

OTHER OPTIONS

Download

[OpenDocument Spreadsheet .ods] [Size: 30 KB]

What is the purpose of using the business budget planning tool?

A business budget is a blueprint that a business uses for managing all the financial resources it has. This enables the corporation to make informed decisions regarding all the operations it performs.

What are the basic uses of the business budget?

Businesses usually use business budget sheets for a variety of purposes as all of them want to grow and flourish. If you keep benefits of budgeting for a corporation have been listed below:

It can keep track of operating expenses:

Money that a business spends on its operations is known as operating expenses. There are two categories in which operational expenses are divided. These two categories are variable and fixed expenses.

Fixed expenses are those expenses that never change regardless of the business activity. In other words, these are the expenses that a business has no control on. Then there is another category of variable expenses which includes the cost of activities that fluctuates and therefore, no business is sure how much they will have to pay. These costs include utility bills, total commissions to be paid to employees, and much more.

It can forecast the revenue:

A business needs to be in a position in which it can see the revenue it is expected to generate shortly. Forecasting the revenue requires some specific details that are provided in this business budget sheet.

The budget sheet estimates the sales that are expected during the specific period for which the budget is being made. In addition, it also gives the breakdown of the revenue depending on where it is coming from such as the revenue generated through customers, through selling different products, and much more.

It gives a clear estimate of corporate taxes:

Payment of income tax is extremely important for a business and cannot be ignored at all. However, it becomes difficult for an organization to keep track of different types of taxes such as property taxes, sales taxes, and many others. This sheet never lets it lose sight of the taxes it has to pay to the state.

A business can perform budget variance analysis:

A budget generally includes two types of costs which are the actual ones and those which were planned by the business owner and those which are being incurred. When the comparison between these two costs is made, it can be seen clearly how much the budgeted costs deviated from the actual ones.

This way, it can be seen how well the budget sheet has worked and what a business can expect in the future. In other words, the reliability of the budget sheet can be determined.

The bottom line:

If a business is in a position to use a well-planned budget sheet, it will be able to allocate its resources efficiently and achieve the financial goals it has set. Usually, the budget sheet provides a road map to follow. The budget sheet is also known as a financial management and planning tool as it helps in both. A corporation can easily control its expenses and also make decisions that are highly useful for it.

When a corporation performs regular monitoring of the budget, all of its actions become more aligned with its financial goals. This way, everything becomes easy and smooth as the market conditions are also kept into account when a budget planning tool is used.

- Employee Performance Review Sheet

- Reward Chart Template

- Fuel Claim Form Template

- Wedding Invitation Tracker

- Food Budget Estimate

- Rent Affordability Calculator

- Student Budget Sheet

- Personal Budget Tracker Template

- Project Budgeting Sheet

- Funding Request Worksheet

- Management Team Worksheet Template

- SWOT Analysis Worksheet Template

- Stock Register Template

- Business Budget Sheet Template

- Fuel Budget Calculator

- Collaborative To-Do List

- Marketing and Sales Strategy Worksheet

- Project Expense Report Template

- Operational Plan Worksheet

- Travel Budget Worksheet Excel Template

- Employee Absence Schedule Template